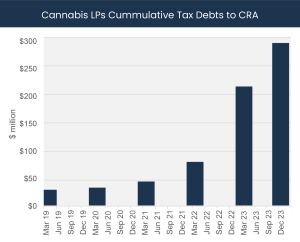

Since 2021, the unpaid Canada Revenue Agency (“CRA”) excise tax has been a growing concern for the government agency and unpaid amounts ballooned to $273.4 million in 2023[1]. In response to the increasing amount of unpaid taxes, the CRA has announced it will force the provincially owned cannabis wholesalers to garnish payments intended for licensed producers in arrears[2].

While this is an unprecedented move it speaks to the challenges pervasive across the industry. As per MJBizDaily, in March 2023 69.8% of cannabis corporations required to pay excise tax had failed to pay them in full[3]. This level of delinquency is a signal that the industry taxation model is disconnected from the industry’s profitability model. In recent cannabis LPs’ CCAA filings, the CRA has been named among the largest unsecured creditors. For example, in BZAM Group’s filings, there was $4.44 million excise tax in arrears[4].

In cannabis, excise rates are the same for all LPs, regardless of size: $1.00/gram or 10% of the value of the gram, whichever is greater. Compared to beer producers, excise payments are dependent upon commercial scale: a rate of $0.3087/litre for the first 200,000 litres produced, $0.6174/litre for the next 300,000 litres produced, rising incrementally to $2.6240/litre for production over 5,000,000 litres[5].

If we dig further the overall percentage of excise tax as compared to retail sales is also drastically higher in cannabis as opposed to beer and wine. Although excise tax is not calculated based on retail pricing, these figures provide an objective comparison between industries. In 2022-23 beer and wine excise tax combined was $887.7 million with retail sales reaching $26.3 billion, making the beer and wine excise tax 3.4% of total sales. In the same period, cannabis retail sales reached $4.7 billion and cannabis excise tax was $894.6 million or 19% of total sales[6][7].

*Source: Canada Revenue Agency

The federal government has also recently announced that the annual alcohol excise tax increase on beer, spirits, and wine will remain at two percent for an additional two years, despite originally being set to rise on April 1 by 4.7 percent, tied to inflation. “In recent years, we’ve seen that the cost of key ingredients for beer … are rising due to the impact of global inflation, and that’s been a real challenge for brewers in Canada,” Finance Minister Chrystia Freeland said. “Our government really recognizes the value, particularly of small businesses … and we also recognize the affordability challenges, so that’s why we’ve taken this decision”[8].

The Canadian cannabis industry, which is also comprised of small businesses impacted by increasing costs, is looking for similar support from the federal government. Broadly the industry is looking for the implementation of a 10% flat tax, recommendation #329 from the House of Commons Standing Committee on Finance[9].

A flat 10% tax would bring tax parity to the cannabis industry compared to other Canadian industries, allowing for stabilization of margins which would stop the flood of bankruptcies in the sector. The move by the CRA to garnish whole invoice payments as opposed to a percentage by the provincial wholesalers will drive an increase in LPs that will be forced to shutter or seek creditor protection. CCX expects to see an uptick in wholesale activity as LPs look to diversify their revenue streams and ensure cash flows. B2B sales allow LPs to collect funds faster and reinvest in their next grow cycle versus the longer lead times required to retail.

[1] https://mjbizdaily.com/canada-unpaid-cannabis-taxes-soar-to-almost-ca300-million/

[2] https://mjbizdaily.com/canadian-cannabis-wholesalers-must-garnish-payments-over-unpaid-taxes/

[3] https://mjbizdaily.com/canadian-cannabis-wholesalers-must-garnish-payments-over-unpaid-taxes/

[4] http://cfcanada.fticonsulting.com/bzam/docs/BZAM%20-%20Initial%20Factum.pdf

[5] https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/edrates/excise-duty-rates.html

[6] https://www150.statcan.gc.ca/n1/daily-quotidien/240306/dq240306a-eng.htm

[7] https://mjbizdaily.com/canadian-federal-cannabis-tax-revenue-outpaces-beer-wine/

[8] https://www.cbc.ca/news/politics/alcohol-excise-tax-capped-two-years-1.7139374

[9] https://www.ourcommons.ca/documentviewer/en/44-1/FINA/report-16/page-123#33